Investing in property can be a lucrative way to build wealth, but it’s essential to understand the tax implications to maximize your returns. This guide will cover the full life cycle of property investment taxation for new investors

ATO Small Business Skills and Training Boost

The Australian Taxation Office (ATO) recognizes the importance of continuous learning and has introduced the Small Business Skills and Training Boost program

Temporary Full Expensing Ends 30 June 2023

Temporary Full Expensing finishes June 2023. Replaced by Immediate Asset Write-Off with more restrictions.

⚡Do you want a 100% tax deductible car? ⚡

ATO FBT Exemption for Electric Vehicles Explained

We break it down to explain what fringe benefits tax is, who can get the exemption, and why the Electric Vehicle (EV) exemption is such a good deal.

Federal and State Governments in Australia are now offering incentives to encourage the uptake of zero-emission vehicles. The Federal FBT Exemption is the biggest incentive available at the time of writing this. This can give you roughly a 40% discount.

Did you know you can now get a Tesla for less than a Toyota Corolla?

You need satisfy 3 main elements to qualify:

- You must be an employee or an associate of an employee

- Select an EV that qualifies by price and first use date

- Have your Employer provide the EV to you as a Fringe Benefit –

- commonly organised via a Novated Lease for employees

- small business owners – speak to your accountant

BENEFITS:

Assuming you have satisfied the above points you can:

- Save TAX – by having the cost of the car come out of your pre-tax income, regardless of your work usage of the vehicle.

- Avoid paying for fuel into the future and the stress of fuel price fluctuations.

- Save GST

- Get a $67,000 EV for less than a $36,000 Internal Combustion Engine (ICE) car. See our example below

- Potentially get State Government incentives that waive or reduce stamp duty – check your state rebates below:

- Environmental impacts are reduced:

- NO fossil fuel is burnt to propel the car

- Mining, transport and refining of fuel is not required

- No fine particle emissions from exhaust fumes

Common Concerns with EVs

Humans are creatures of habit. Any change comes with concerns but we have found that the benefits of EV adoption far outweigh any concerns people may have.

- Where do I charge? Most people plug into a regular power point at home. This adds about 120km of range over night via a regular 10 amp power point. You can get faster charging setups at home if required.

- How far does the car go on one charge? Most new EVs have a range of 300 – 500km on a full battery, depending on the make and model and size of the battery. Tesla Model Y RWD has a range of 432km for example with a 60Kwh battery. Similar to a tank of fuel.

- EVs Cost Too Much. We agree they are expensive upfront. This is why the FBT exemption is so good. This reduces the total cost of ownership by around 40%. Like all new technologies they start out very expensive and reduce in cost over time. Like flat screen TVs did a decade ago.

- There are not many EVs Available: True, for now – there are about 14 Battery EVs available in Australia in Feb 2023 in the $40k to $80k price range that will be possible to acquire with FBT Exemption. Vehicle manufacturers are ramping up their range so many more will be available in the coming years.

- Can I go on road trips? Yes! Absolutely. There is an extensive network of fast chargers around Australia. Fast chargers can add 80% battery charge in under 15 minutes. Tesla is opening it’s industry leading supercharger network to non-Tesla EVs as well.

- Can I Tow?: Yes but this will reduce range just like it will in an ICE vehicle. There are some bigger towing vehicles coming but they are likely to be more expensive than the LCT limit.

- Won’t the battery die in a few years? No. New battery technology allows for 10,000 charging cycles. So batteries will likely outlast the vehicle itself.

We have staff who have already taken advantage of this amazing deal so we have real world experience. If you are interested please read the details below.

DISCLAIMER: Please note that the financial examples provided on this page is for illustrative purposes only and should not be construed as financial advice. The figures and calculations used may not be accurate or applicable to your specific financial situation. It is important to seek professional financial advice before making any investment decisions. The author and publisher of this example shall not be held liable for any damages or losses incurred as a result of using the information provided.

What is a Fringe Benefit?

FBT, or Fringe Benefits Tax, is a tax system in Australia that applies to non-cash benefits provided to employees or their associates as part of their employment. These benefits can include things like company cars, health insurance, and expense accounts, among others.

FBT is an important part of the Australian tax system, as it helps to ensure that employees are not receiving excessive tax benefits through their employment arrangements. It also helps to maintain fairness in the tax system, by ensuring that all employees are subject to similar tax obligations regardless of their employment arrangements.

When an employer provides a fringe benefit to an employee, they are typically required to pay FBT of 47% on the taxable value of the benefit. However, if the employee makes an employee contribution towards the cost of the benefit, this can reduce the taxable value of the benefit and therefore reduce the amount of FBT that the employer is required to pay.

For example, if an employer provides an employee with a company car, they may be required to pay FBT on the value of the car. However, most workplaces require employee to make an employee contribution towards the cost of the car to eliminate any FBT that the employer may have been required to pay.

How Does This Apply To Electric Vehicles?

Like everything relating to tax, it is a bit complicated.

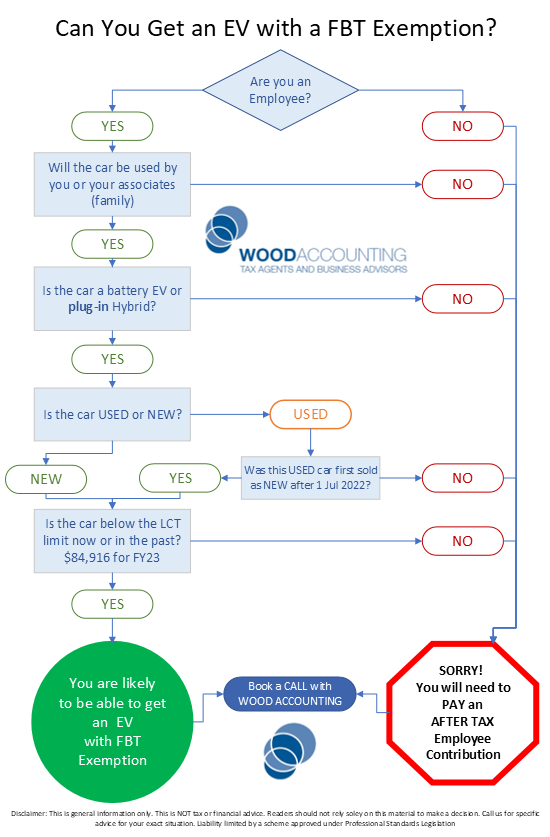

To get an EV as an FBT Exemption you must meet ALL of the following criteria:

- ✅The vehicle must be zero or low emissions.

- ✅The first time the vehicle was held and used by ANYONE must be after 01 July 2022

- ✅The car is used by an employee or their associate (ie family members)

- ✅Luxury Car Tax (LCT) has never been payable on the importation of the vehicle.

We quickly expand these points below

1- What is a Zero or Low Emission Car?

Good question. Also complicated.

ATO defines Zero and Low Emission cars this as follows:

- It is a:

- Battery Electric Vehicle (BEV)

- hydrogen fuel cell electric vehicle, or

- Plug-In Hybrid Electric Vehicle (PHEV)

- MUST BE PLUG IN – not just a “hybrid” that charges off the petrol engine.

- Plug-in Hybrid exemptions EXPIRE 31 March 2025.

- It is a car designed to carry a load of less than 1 tonne and fewer than 9 passengers (including the driver). Above 1 tonne and/or 9+ passengers are Non Cars and no FBT Exemption applies.

Motorcycles and scooters are not cars for FBT purposes and do not qualify for the exemption, even if they are electric.

2 – First Used after 1st July 2022

Basically the vehicle must have been first purchased NEW on or after 1 July 2022.

This means the exemption would NOT apply to the purchase of a 2nd hand vehicle that was first used before 1 July 2022.

So to be clear here are 2 quick examples:

- Buy a used 2019 Tesla Model 3 in December 2022. This car was first registered and used in 2019 – FBT Exemption DOES NOT apply – as first use was before 1/7/22.

- Buy a used 2022 BYD Atto 3 in Feb 2023. This car was first used in October 2022. You can get the FBT Exemption on this vehicle as it was first used AFTER 1/7/22.

3 – Car Must Be Used by an EMPLOYEE or Their Associates

This is important.

There must be an Employer – Employee relationship in order for a Fringe Benefit to arise.

The exemption only applies during the employment relationship. I does not apply before or after an employment arrangement is active.

SOLE TRADERS do not qualify as they are NOT employees.

Quick definitions:

Employer = The entity with which an employee has a contract to provide their labour. Written or otherwise. Usually a company or trust which would provide the employee with a payslip, super etc.

Employee = A human who has agreed to work for an entity. Self employed people are included here AS LONG AS they are an employee of their own company or trust.

Sole Trader = Human who has an ABN and works for themselves, issuing invoices for work. Not on payroll. Can’t provide a Fringe Benefit as there is no employee/employer relationship.

4 – Below Luxury Car Tax (LCT) Limit

To be eligible for the FBT Exemption, the value of the car MUST have been below the LCT threshold for fuel efficient vehicles:

- at the time it was a new vehicle,

- AND in any subsequent sale

If you buy a 2nd hand EV you will need to get confirmation that it was NOT subject to LCT at any time in the past.

You can check the LCT Threshold for Fuel Efficient Vehicles on the ATO website here

CONFUSED? Use our Flowchart to help understand

You Think You Qualify – Now What?

Small Business Owners – If you use a company or trust structure and pay yourself or family wages, talk to us or your Accountant, to confirm that you qualify.

For employees – speak to your HR department or your boss to confirm that you are able to salary sacrifice a novated lease. Then contact the novated lease provider to organise the car.

Sole Traders – sorry, you don’t qualify. FBT does not come into it for you. Your vehicle tax deductibility is assessed by logbook business use percentage.

Example: Comparison of Novated Lease for Electric Vehicles

Electric Vehicle (EV) vs Internal Combustion Engine (ICE) vehicles.

Mr Wood is looking for a new car. He has rounded it down to 2 of the top selling vehicles in Australia in 2022.

Mr Wood’s circumstances are as follows:

- Self employed on wages

- Full time earning around $100,000 gross per year

- Employer agrees to salary sacrificing a novated lease

- Has had the same job for 2+ years and has a mortgage on a home for 2+ years as well – banks and novated lease companies want to see this most of the time.

- Both cars are new purchases AFTER 1 July 2022

- Both cars are under the Luxury Car Tax (LCT) limit – $89,332 for fuel efficient EVs or $76,950 for other vehicles in FY 2024.

- Running costs to be part of the packaged repayments.

- Employer or novated lease company will reimburse the costs of charging at home as an expense claim. Subject to negotiations.

| | Toyota Corolla | Tesla Model 3 |

| Driveaway Price – estimated at Feb 2023 | $36,500 | $67,485 |

| Est. Running Costs – rego, ins, fuel/power, repairs | $5,500 | $4,500 |

| Est. Loan repayments – 60mths, no residual @8% | $8,881 | $12,348 |

| Total Estimated Running Costs Per YEAR | $14,381 | $16,848 |

| ——–ANNUAL PAY AFFECT for Salary Sacrifice——– | ||

| Employee Taxable Income | $100,000 | $100,000 |

| Less: Pre Tax Deduction | ($6,716) | ($16,848) |

| New Taxable Income | $93,294 | $83,152 |

| INCOME TAX WITHELD | ($22,650) | ($19,154) |

| Less: Post Tax Deduction – Statutory Method | ($7665) | ($0) |

| Net Income to Bank – per year | $62,969 | $63,998 |

Conclusion

The above example, using real world numbers, shows that you can get a relatively expensive EV for less than an ICE vehicles despite the drive away price being so different.

Before considering an EV, Mr Wood was earning $100,000 gross income, less $25,000 tax withheld, resulting in him receiving $75,000 into the bank after tax.

Tesla – After pre-tax deductions and tax the income to bank for Mr Wood is $63,998. So compared to the $75,000 above, the Tesla option costs $11,002 out of pocket per year.

This car would have cost him $16,848 after tax had he not salary packaged. $5846 saved per year. This would reduce the cost of the car by more than $29,000 over 5 years. A massive 40%+ saving on the original price of the vehicle.

Corolla – After pre-tax deductions and tax the income to bank for Mr Wood is $62,969. So compared to the $75,000 above, the Corolla costs Mr Wood $12,031 per year.

This would have cost him $14,381 after tax had he not salary packaged. $2,350 saved per year.

So which one is cheaper? The Tesla. Why? This is due to the FBT Exemption. Mr Wood would have a lower out of pocket cost per year.

This is an example so please do your own calculations or ask an expert to assist you to make a decision.

What Else Do You Need to Know?

- Your employer still needs to calculate a Reportable Fringe Benefit Amount (RFBA) and report this on your Annual Income Statement to ATO via Single Touch Payroll. You do not pay income tax on this amount, but it does impact income tests for child support, family assistance, HECS, Medicare Levy and some other Government benefits.

- RFBA for exempt EVs does not impact FBT liability for the employer. It is also not included in:

- certain non-profit employers – The $17,000 or $30,000 exemption cap

- for rebatable employers – the $30,000 rebate cap

- The Government will review this exemption by mid-2027 to consider EV take up and decide if the exemption continues.

- Installation of an electric vehicle charging station in the home of the employee is NOT FBT Exempt. That is a property fringe benefit to the employee.

- TESLA REFERRAL BONUS – If you are thinking of ordering a Tesla you can get a discount or referral points by using our referral code. We get referral points and you get a discount. Everyone’s a winner.

ATO have released a Electric Vehicle and FBT FACT SHEET here if you would like to read more.

Want to discuss your options? Book a call below or send us an email.

DISCLAIMER: Please note that the financial examples provided on this page is for illustrative purposes only and should not be construed as financial advice. The figures and calculations used may not be accurate or applicable to your specific financial situation. It is important to seek professional financial advice before making any investment decisions. The author and publisher of this example shall not be held liable for any damages or losses incurred as a result of using the information provided.